Get more from your merchant relationships using the world’s leading end-to-end operating system for merchant cash advances.

Watch the Video

Small business owners value speed and convenience from their vendor relationships. Does your merchant cash advance program deliver the goods?

Turnkey Solution to Create or Scale Your Lending Program

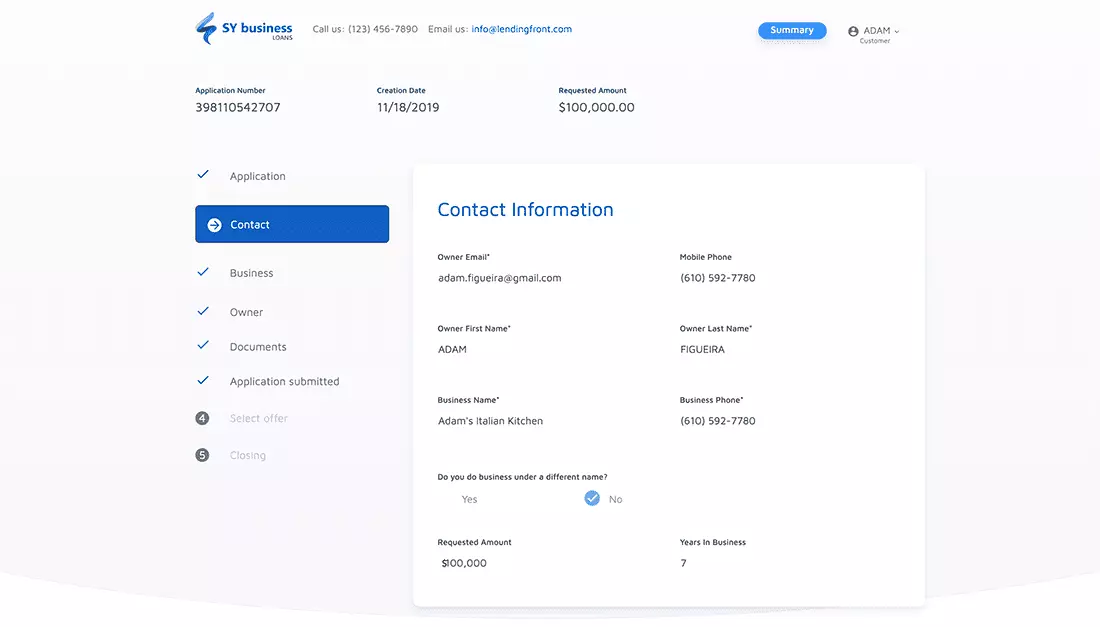

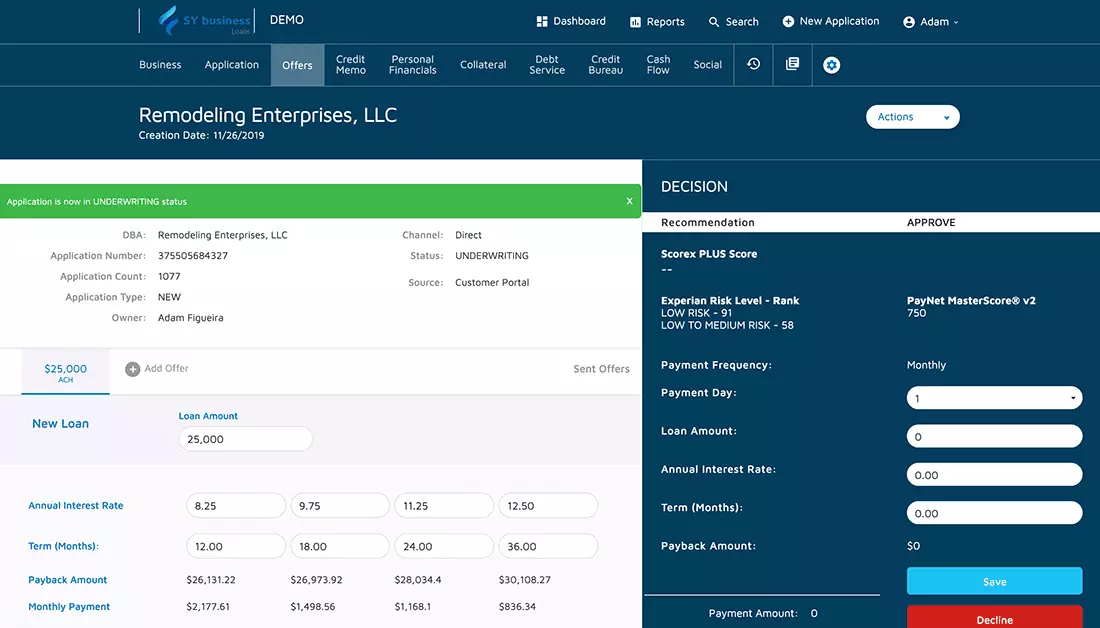

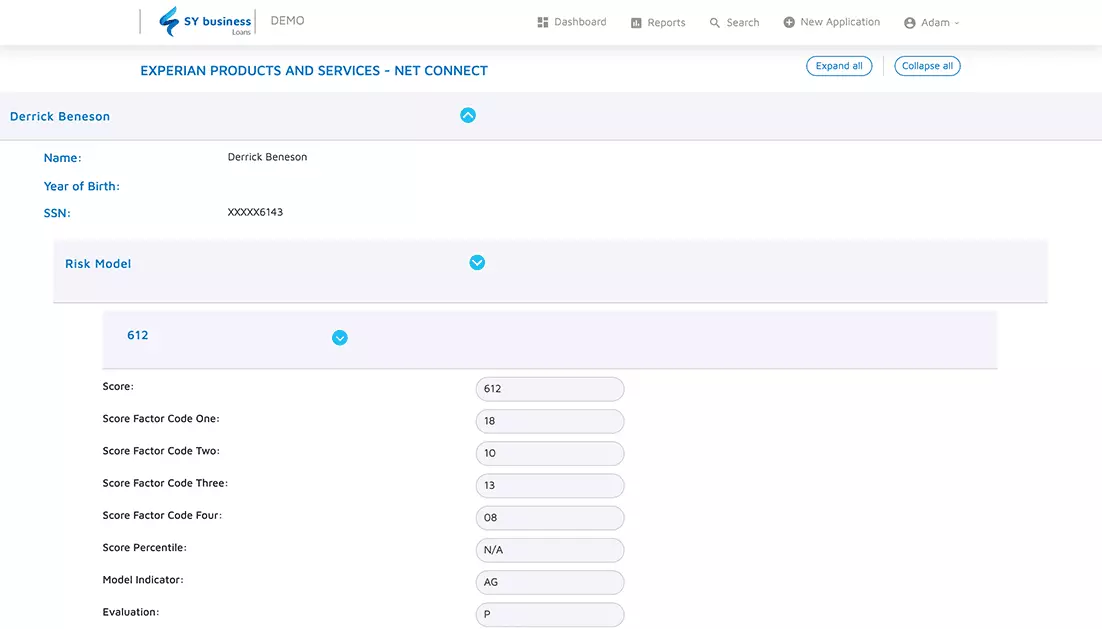

Small businesses need capital, and there’s a growing expectation merchant processors offer it—or your customer becomes a flight risk. Yet, for many merchant processors, outdated technologies, manual processes, and a lack of lending expertise makes running such a program easier said than done. LendingFront’s end-to-end operating system for merchant cash advances delivers everything you need in a single package—pre-approval messaging, application intake, gathering required information, data aggregation, underwriting, offer presentation, e-contracts, servicing, and more.

Automation and Rules-Based Decisioning

Eliminate manual processes that extend time and reduce efficiency. Whether it’s document collection, automatic status updates, or anything in between, LendingFront’s sophisticated workflow management capabilities make it easy to deliver a streamlined borrowing experience for time-pressed business owners. Define underwriting criteria, manage communications, deploy simple web-based loans contracts, and more.

Complete Control and Transparency

Unlike other solutions, we built LendingFront to work the way you wanted it. From the application experience, required information, underwriting criteria, and more--LendingFront supports a 100% lender-defined process with no compromises around control or transparency. You’ll have access to a comprehensive activity audit of every action taken on each application, along with the ability to view your entire loan portfolio by Stage, Sales Rep, or Territory. A series of APIs also make it easy for you to build on top of LendingFront’s core operating system.

Built for the Future Ready for Today

Competition for business borrowers is higher than ever before. LendingFront helps you level the playing field. Our cloud-based delivery platform is complemented by daily backups, weekly vulnerability scans, continuous uptime monitoring, and the best professional services team in the business.

How LendingFront Works

LendingFront is the world’s leading end-to-end platform for merchant cash advances, enabling merchant processors to leverage their platforms and data to deliver pre-approvals, present offers, disburse funds, and more.

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.