Level the playing field. Become a powerful lender to small businesses.

Watch the Video

Lending to small businesses is harder than it should be.

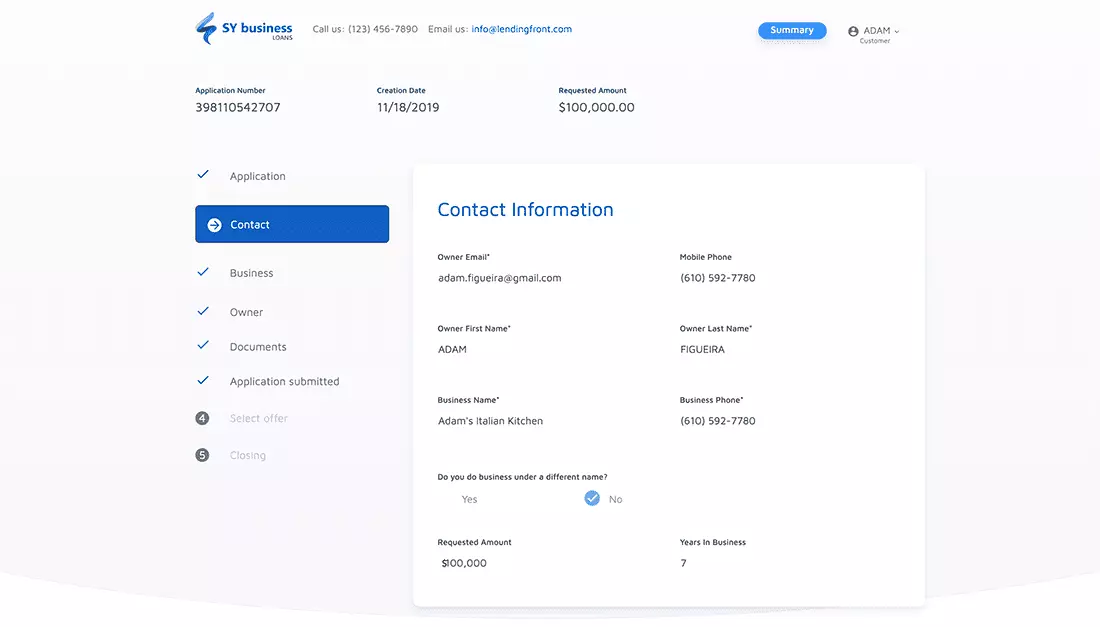

Separate Small Requests from the Commercial Lending Process

Many community banks process small and large credit requests in exactly the same way. LendingFront helps you separate small credit requests from the traditional commercial lending process. That means it’s easy for small business customers to start and submit their applications online. In fact, you can digitally enable the entire small business lending process including offer presentation, digital contracts, loan servicing, and more.

Unit Economics that are “Right-Side Up”

The traditional process for handling small credit requests is slow, time-consuming, and banker-driven. That makes it expensive, and it’s the #1 reason why SMB lending is unprofitable for many community banks. LendingFront helps you maximize your profits on every single small business loan. Eliminate manual processes that extend time and reduce efficiency. Whether it’s document collection, status updates, or anything in between, LendingFront’s sophisticated workflow management capabilities make it easy to deliver a streamlined borrowing experience for time-pressed business owners.

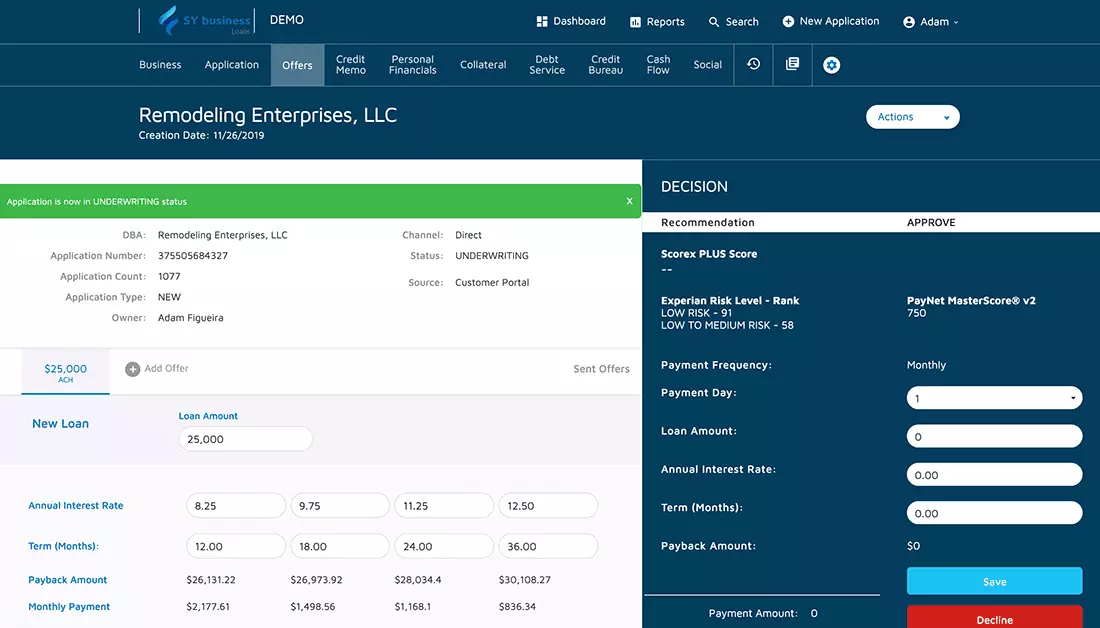

Complete Control and Transparency

Unlike other lending solutions, we built ours to work the way you wanted it. From the application experience, required information, underwriting criteria, and more--LendingFront supports a 100% lender-defined process with no compromises around control or transparency. You’ll have access to a comprehensive activity audit of every action taken on each application—along with the ability to view your entire loan portfolio by Stage, Sales Rep, or ISO. A series of APIs also make it easy for you to build on top of LendingFront’s core operating system.

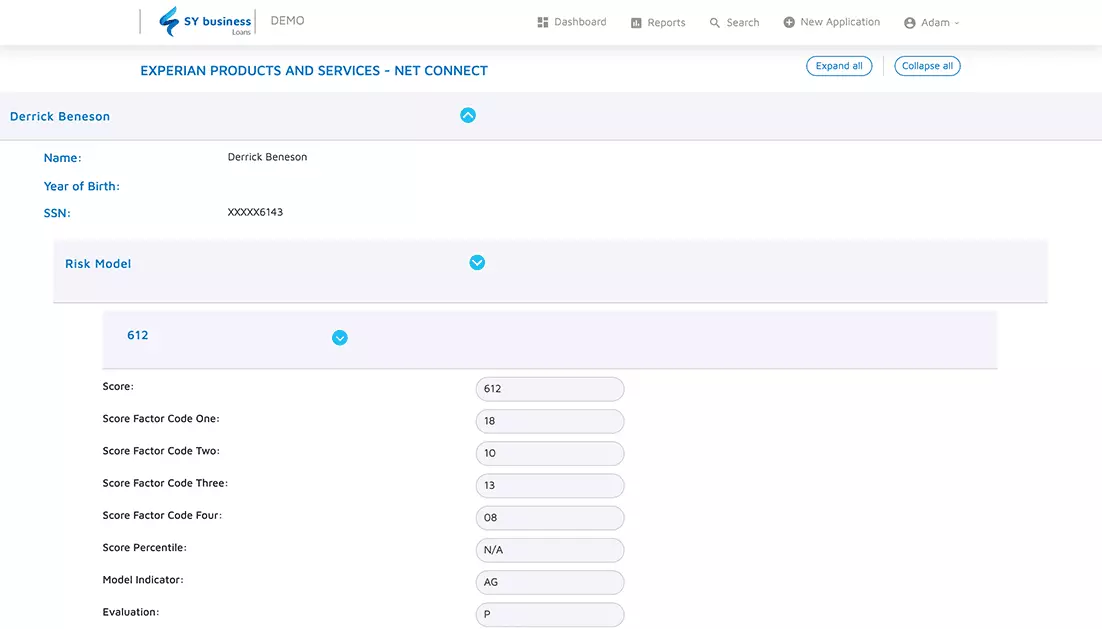

SMB-Specific Credit Criteria

The traditional underwriting criteria—things like credit scores and last year’s tax returns—are lagging indicators of a business’ creditworthiness. With LendingFront, it’s easy to layer in additional data that reveal how a business is performing right now, such as real-time cash flow data. The result isn’t just faster, more efficient lending decisions, but smarter decisions as well.

How LendingFront Works

LendingFront is the world’s only end-to-end business lending solution for community banks. Applicants easily self-serve, handling everything from document collection, offer selection, e-contracts, and more. With 24/7 availability, small business borrowers get the speed and convenience they need, while lenders extend capital more efficiently and see their money go further.

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.