Become a powerful lender to your small business members

Watch the Video

Strengthen your member relationships through a dramatically improved lending experience.

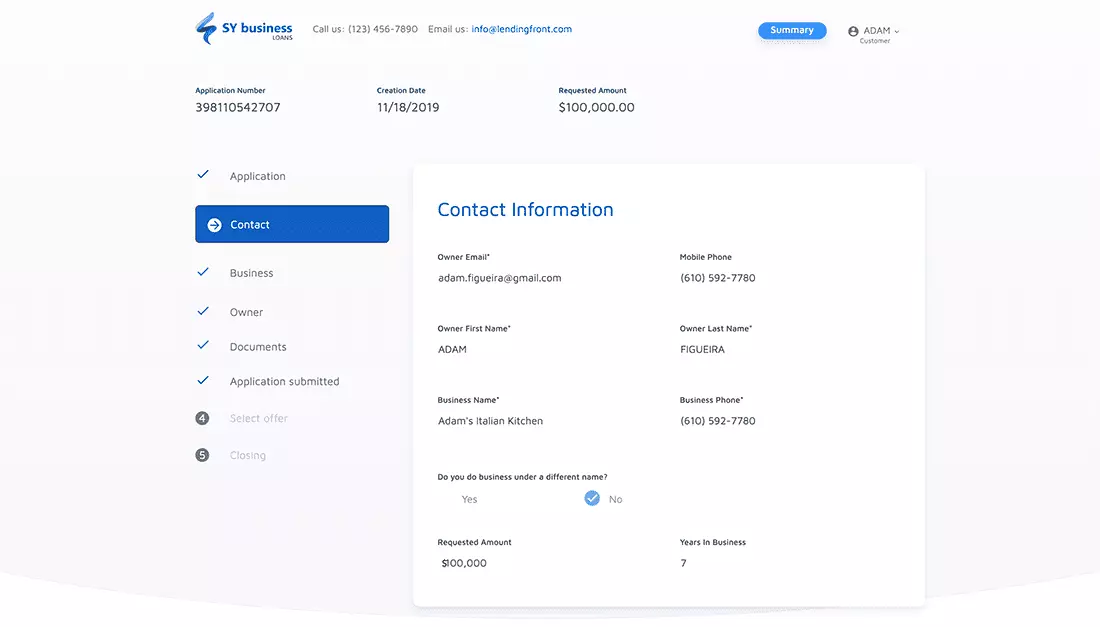

Deliver the Speed and Convenience Members Want

We understand the importance of having personal relationships with your members. However, for the owners of small businesses, the definition of a relationship has changed. LendingFront helps you deploy a fully-digital, end-to-end lending experience for small business members. Easily start and submit credit applications entirely online (although you can also deploy LendingFront inside your branches!) In fact, you can digitally enable the entire small business lending process including offer presentation, digital contracts, loan servicing, and more.

Scale Up or Start from Scratch

Did you struggle to keep up with capital demand during the PPP program? You’re not alone—although many credit unions don’t do business lending at all. Whether you’re struggling to find scale and efficiency, or you’re not sure how to get a business lending program off the ground, LendingFront can help. We’ve helped financial institutions increase their loan volume 10x year/year, and have helped others build their lending programs out of nothing. Our teams handle everything from off-the-shelf implementations to the customized “edge cases.”

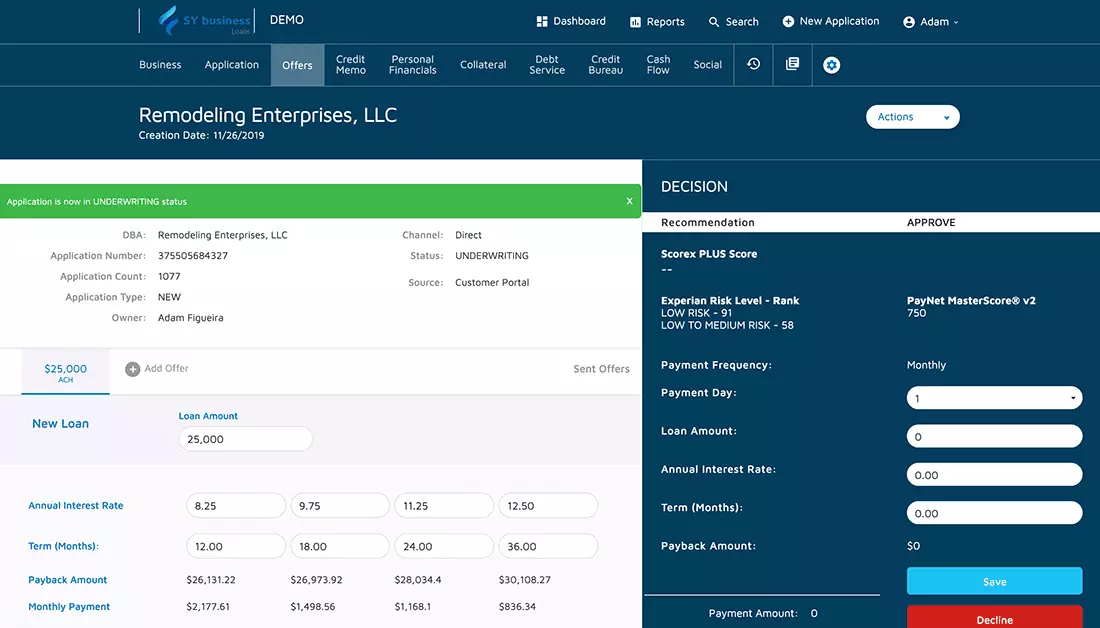

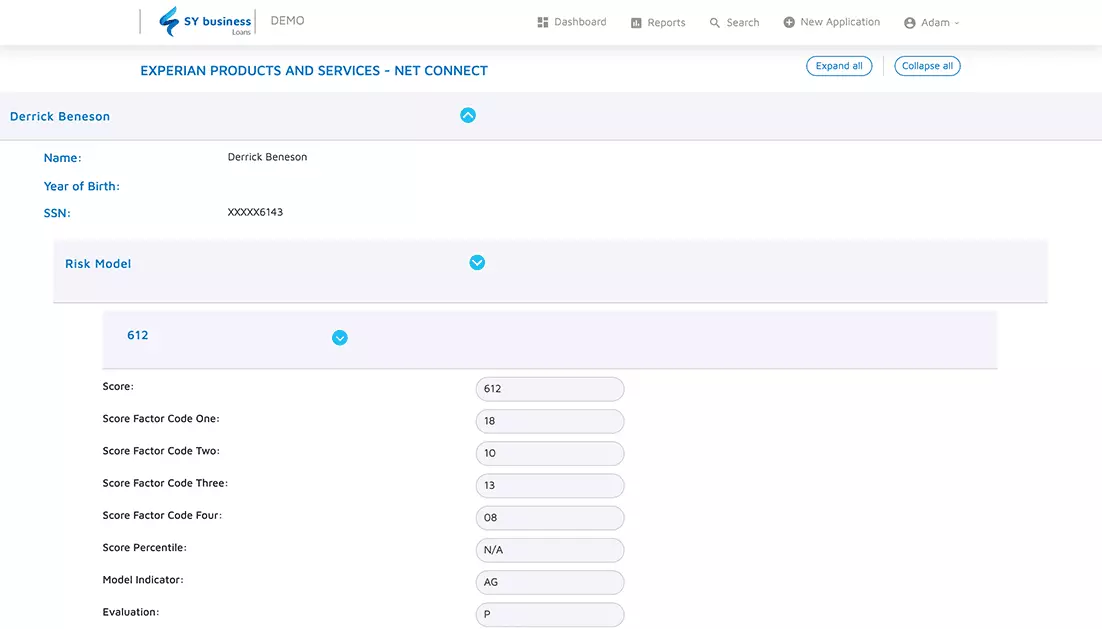

Tap Into SMB-Specific Credit Criteria

The traditional underwriting criteria—things like credit scores and last year’s tax returns—are lagging indicators of a business’ creditworthiness. With LendingFront, it’s easy to layer in additional data that reveal how a business is performing right now, such as real-time cash flow data. The result isn’t just faster, more efficient lending decisions, but smarter decisions as well.

Complete Control and Transparency

Unlike other business lending solutions, we built LendingFront to work the way that credit unions wanted it. From the application experience, required information, underwriting criteria, and more--LendingFront supports a 100% lender-defined process with no compromises around control or transparency. You’ll have access to a comprehensive activity audit of every action taken on each application, along with the ability to view your entire loan portfolio by Stage, Branch, and more.

How LendingFront Works

LendingFront helps credit unions build (or scale) their business lending process. Business members can easily self-serve, handling everything from document collection, offer selection, e-contracts, and more. With 24/7 availability, members get the speed and convenience they need, and credit unions deliver on the growing and diverse needs of the businesses they serve.

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.