Digitally Transform Your Lending Workflow from “A” to “Z”

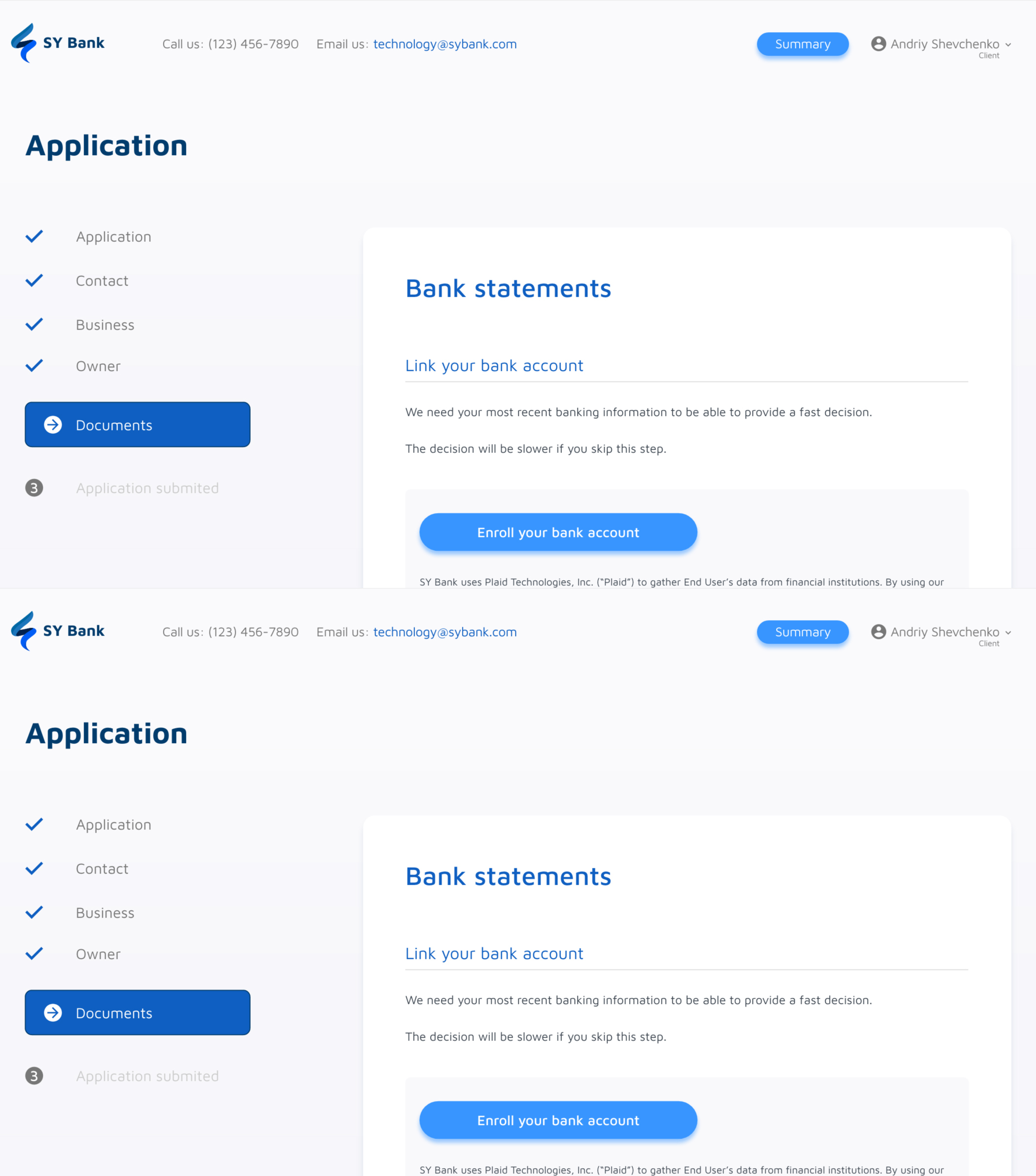

A digitally-enabled lending program involves more than an online application. It’s about harnessing the power of technology to make every step in the process efficient, secure, and less risky. LendingFront’s turnkey digital lending platform powers application intake, document collection, data aggregation, rules-based decisioning, offer-presentation, e-contracts, servicing, and collections.

Digital Enabled

24/7 Accessibility

Multi-Device Access

White Labeled

How it Works

Digitally-Enabled from End-to-End

A lending process can only be as fast as its slowest step. That’s why LendingFront’s consumer lending platform is fully digital from end-to-end. From origination to underwriting to the delivery of funds, there’s nothing that slows you (or your borrowers) down.

Embedded Servicing Engine

It’s great if a lending platform makes it easy to extend capital, but how to get your money back? The answer: LendingFront! ACH payments mean you’re never waiting around for paper checks, and payments can be configured to occur monthly, weekly, or even every day.

Modular Deployment

LendingFront was built to be your one-stop-shop for a best-in-class consumer lending program, but we also know that there’s no such thing as one-size-fits-all. That’s why we built LendingFront to be both modular and extensible. Don’t want the servicing engine? That’s no problem! Want to add an integration with one of your in-house systems? Consider it done!

Extensive Integrations

LendingFront is “platform agnostic” and can integrate with other parts of your technology infrastructure. Whether that’s your CRM, core processor, accounting system, or even a lead referral platform like LendingTree, we play nicely with everyone else in the sandbox.

“We wanted to be a best-in-class lender for our business customers, and that meant having a dedicated platform for originating and underwriting small business loans. LendingFront is the industry’s best technology platform for lending.”

LendingFront By the Numbers

7 to 1

One LendingFront customer consolidated 7 separate systems required to run their lending program into just 1 (and yes, that “1” was us.)

900

Number of loans made by a LendingFront customer in the year after going live. Before LendingFront? Just 27.

105%

Percentage increase in funded dollars year/year for one LendingFront (before and after LendingFront)