Make your money and mission go further using the world’s leading end-to-end LOS for CDFIs.

Watch the Video

“When the COVID-19 crisis forced us to close our offices, BBL’s small business loan program did not miss a beat.”

Director

Baltimore Business Lending

Resilient communities depend on strong small businesses. Is your business lending program up to the task?

The Only End-to-End Lending Platform for CDFIs

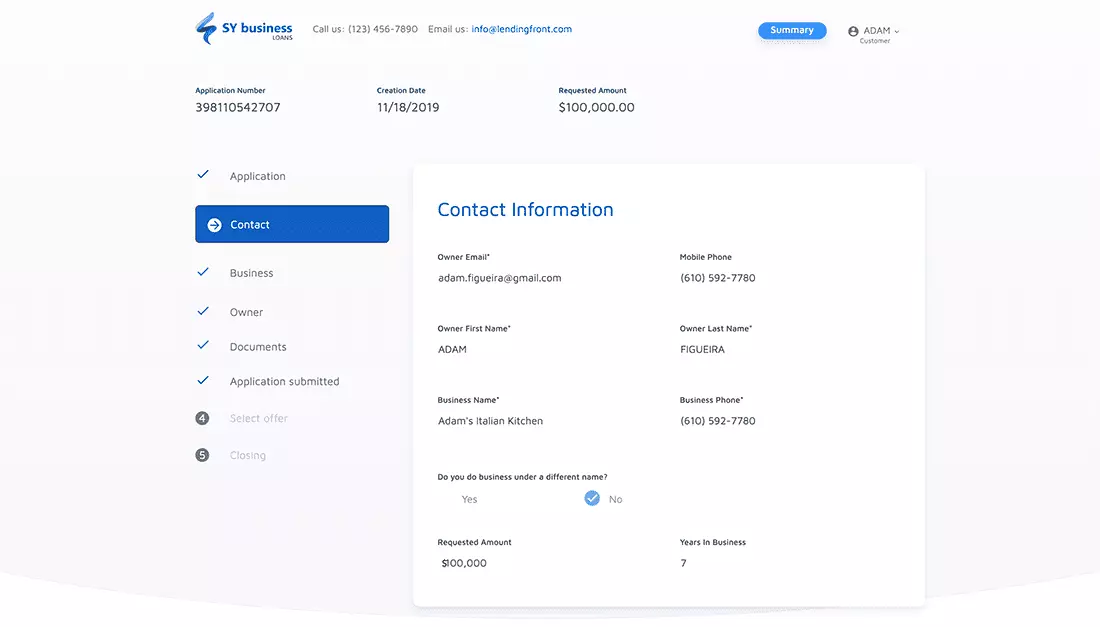

You’re only as fast as the slowest part of your lending process. Unfortunately, for many CDFIs, outdated technologies and a lack of standardization make the process of extending capital slow and expensive. That means businesses and communities are left waiting. LendingFront’s end-to-end operating system for small business lending delivers everything you need in a single package—application intake, data aggregation, underwriting, offer presentation, e-contracts, servicing, and more.

Standardization and Scalability

Eliminate manual processes that extend time and reduce efficiency. Whether it’s document collection, automatic status updates, or anything in between, LendingFront’s sophisticated workflow management capabilities make it easy to deliver a streamlined borrowing experience for time-pressed business owners. Define underwriting criteria, manage communications, deploy simple web-based loans contracts, and more.

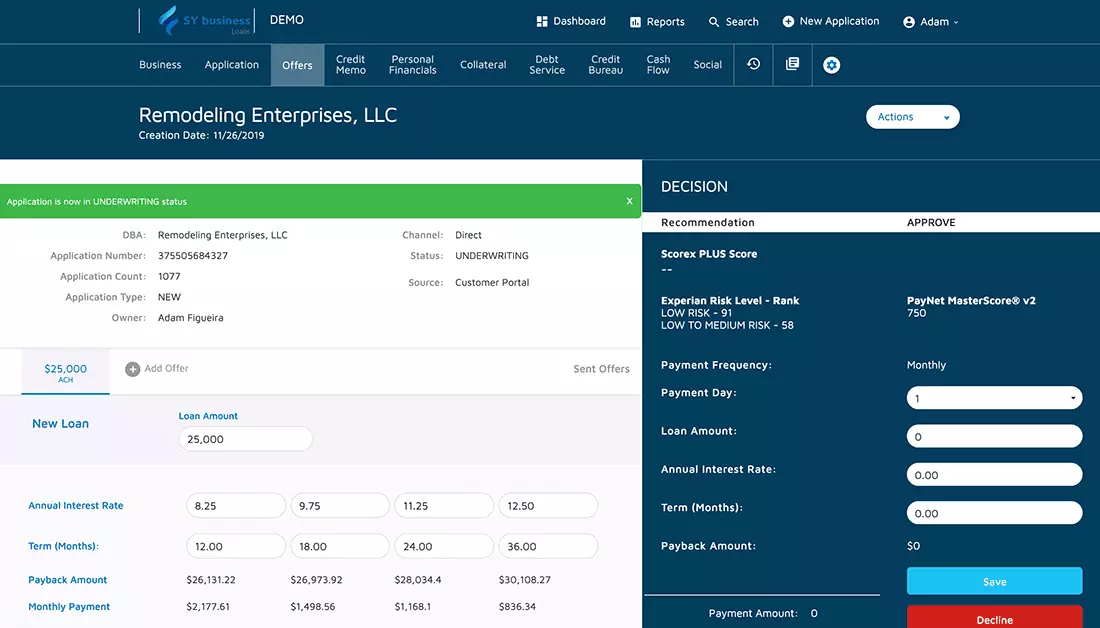

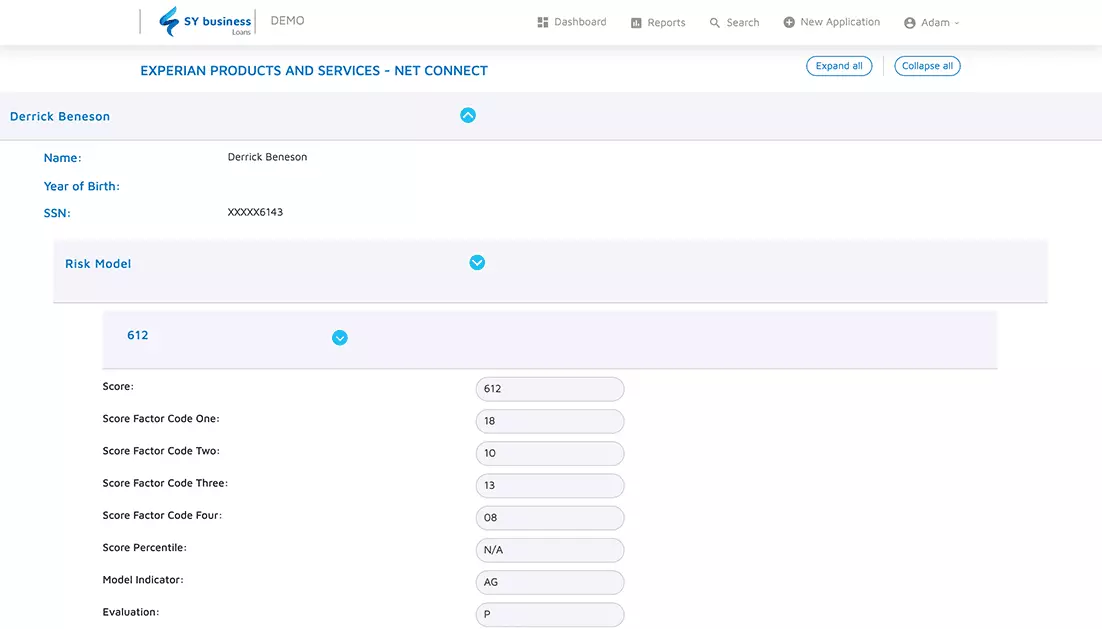

CSMB-Specific Credit Criteria

CDFIs understand that traditional underwriting criteria—things like credit score and last year’s tax returns—don’t paint the full picture. In the post-COVID lending environment, real-time business performance matters more than anything else. With LendingFront, it’s easy to layer in additional data such as daily cash flow and bank transaction activities. The result isn’t just faster, more efficient lending decisions, but smarter decisions as well.

Complete Control and Transparency

Unlike other business lending solutions, we built LendingFront to work the way you wanted it. From the application experience, required information, underwriting criteria, and more--LendingFront supports a 100% lender-defined process with no compromises around control or transparency. You’ll have access to a comprehensive activity audit of every action taken on each application, along with the ability to view your entire loan portfolio by stage, business type, and more.

Tie Loans to Impact

It’s not just about the money, but the difference money can make to a business, its owners, and the community it serves. A series of Impact Reports, tailored to CDFIs, make it easy to see this impact first-hand. With LendingFront, you can easily evaluate the economic and demographic impact of the companies you lend to.

How LendingFront Works

LendingFront is the world’s only end-to-end business lending solution for CDFIs. Applicants easily self-serve, handling everything from document collection, offer selection, e-contracts, and more. With 24/7 availability, small business borrowers get the speed and convenience they need, while lenders extend capital more efficiently and see their money go further.

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.