Digitally Transform Your Lending Workflow from “A” to “Z”

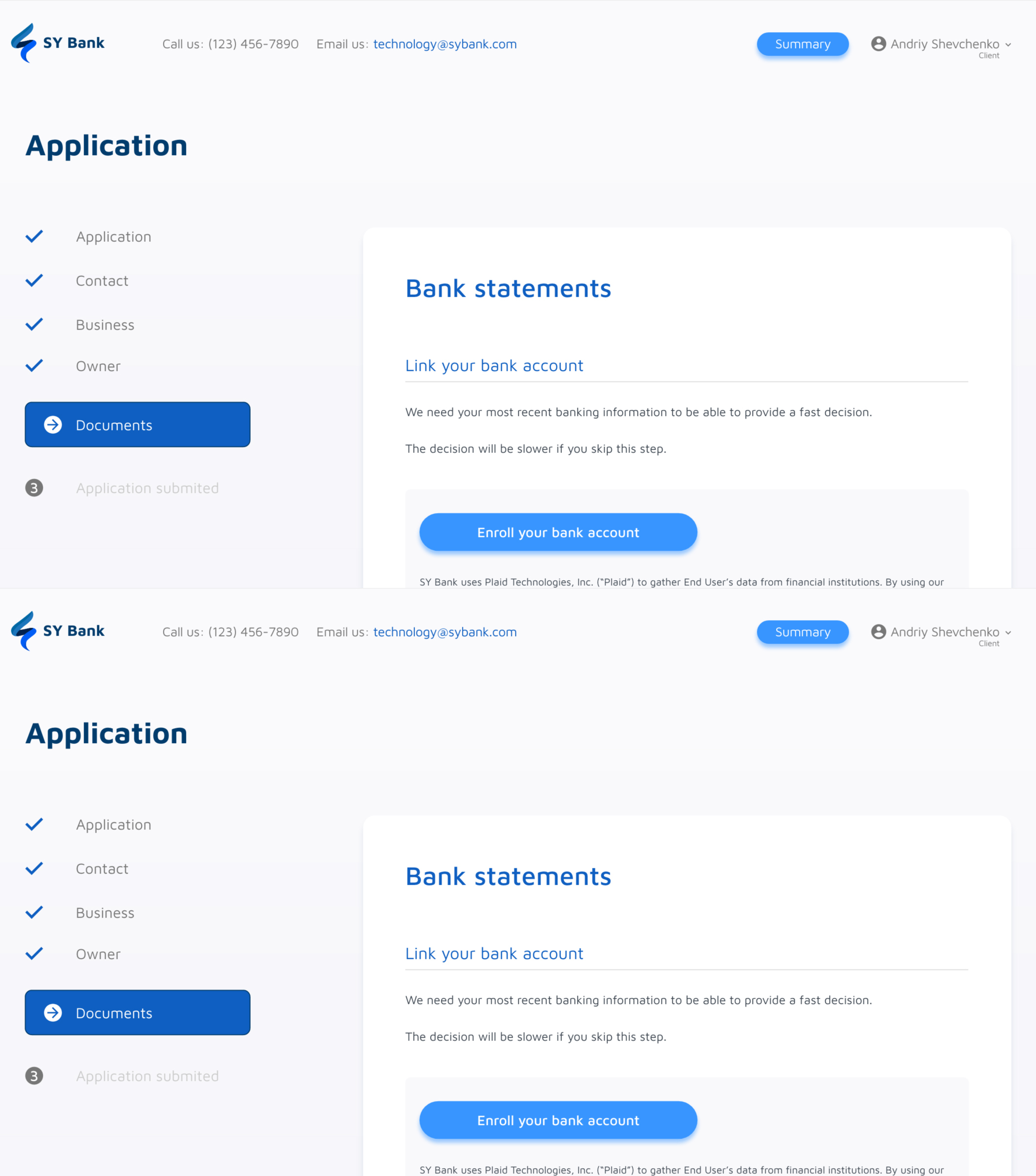

A digitally-enabled lending program involves more than an online application. It’s about harnessing the power of technology to make every step in the process efficient, secure, and less risky. LendingFront’s turnkey digital lending platform powers application intake, document collection, data aggregation, rules-based decisioning, offer-presentation, e-contracts, servicing, and collections.

Digital Enabled

24/7 Accessibility

Multi-Device Access

White Labeled

LendingFront By the Numbers

7 to 1

One LendingFront customer consolidated 7 separate systems required to run their lending program into just 1 (and yes, that “1” was us.)

900

Number of loans made by a LendingFront customer in the year after going live. Before LendingFront? Just 27.

105%

Percentage increase in funded dollars year/year for one LendingFront (before and after LendingFront)