New technologies can position banks for a wellspring of growth, as reported by the American Banking Association (ABA) in 2018. For example, in this age, small business borrowers have every reason to expect loan origination channels to be digitized. And yet, 93% of banks—small and large brands alike—fall short. That leaves just 7% of banks that meet the simplest of borrower expectations.

What this means: your bank, whatever your region or heft, is in a terrific position to capitalize on the gap. Beyond meeting borrower expectations, the right lending platform can give your bank a chance to capture greater loan revenue, with higher margins—and a better experience for borrowers overall.

More revenue? Higher margins? Tell me more.

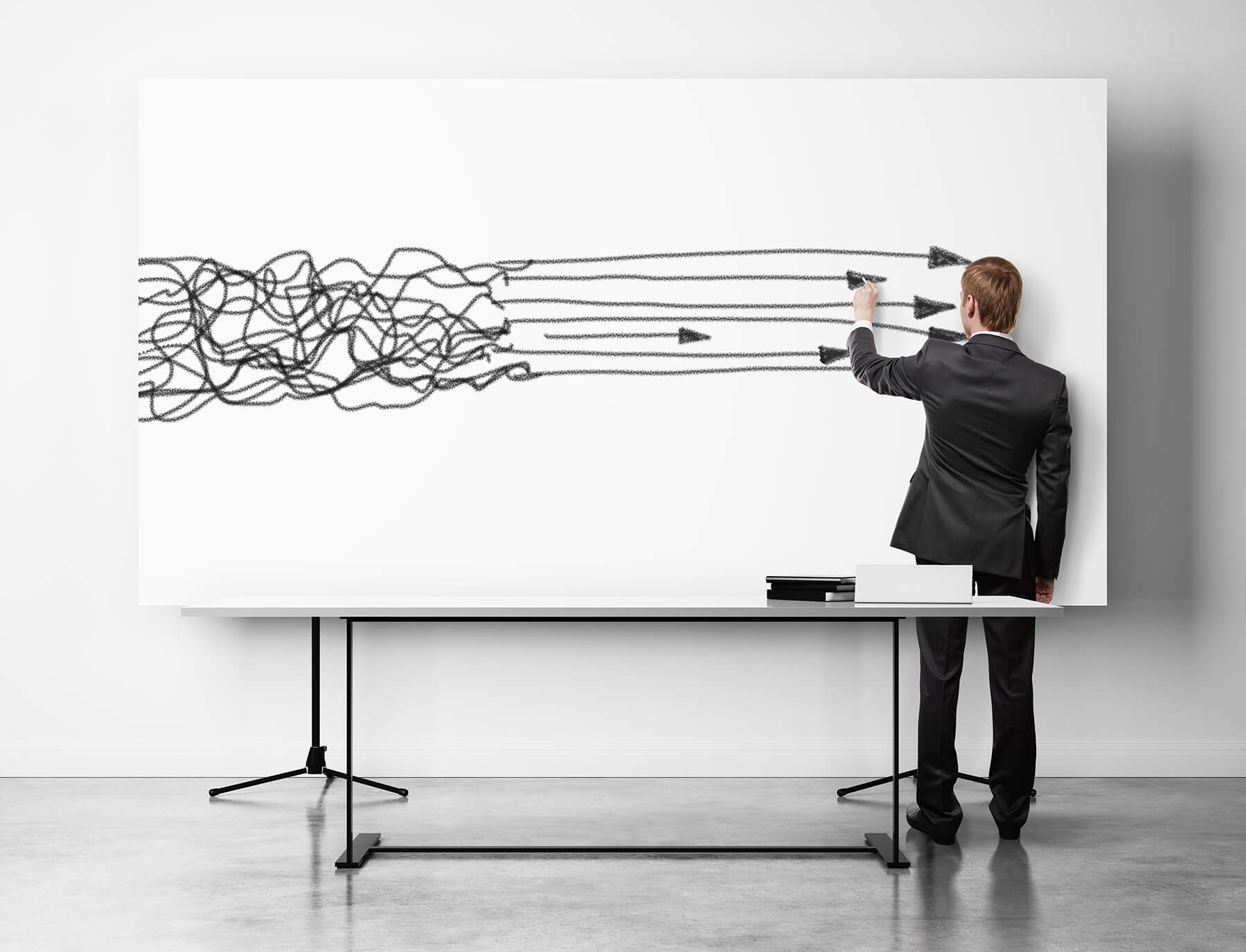

As technology grows more powerful, one capability continues to make a difference: efficiency. Smart tech platforms lend their power to streamlining rote tasks. These very same platforms then serve up higher-level, discretionary work to people. For regional banks and credit unions, efficiency optimizes revenue…particularly when it comes to small to medium business (SMB) lending.

Let’s break this down. Underwriting a loan requires the extensive and careful gathering, collating, and analysis of data, documents, and other information. For every loan, a loan officer must:

- Meet with the applicant and persuade them to apply, with potential follow-ups

- Gather and collate data and documentation—likely in small bursts over a period of days or weeks

- Manage all communications, including answering borrower questions

- Review documentation, calculate risk ratios, apply the bank’s lending rules, and decide whether to underwrite

- If moving forward, set forth conditions and negotiate terms

- Coordinate with lawyers on loan paperwork

- Confirm pre-closing conditions are met

- Close and fund the loan

These tasks are both time-consuming and exponential, since the typical loan officer juggles numerous commercial loan applications at any given time. While crucial to a bank’s revenue flow, these tasks are also distracting: they fall outside higher-level “human” tasks, like relationship building, portfolio management, and purposeful customer service.

While your loan officers may have point solutions in place that help streamline certain aspects of their workflow, juggling multiple disparate solutions can actually drain efficiency rather than boost it—causing missteps, errors, inefficiencies, and confusion.

Precisely because of the extra work involved, your loan officers say no more than necessary, and eager borrowers are turned away. The money in your coffers sits idle, not just because the margins are too thin to meaningfully pursue, but because your bank is at risk of losing money by funding those small dollar value loans.

Now for some enticing questions:

- What if you could automate some (or all) of these steps—while retaining total control?

- What if automation helped you capture more loans in less time—not just by streamlining the work, also but by applying your bank’s own rules to enable loan officers to say “yes” more often?

- What if the very act of automation made those loans more worthwhile—lifting your bottom line?

- What if that same automation also made loans faster and easier for applicants, too? What’s more, what if applicants didn’t have to abandon their SMBs to go to the bank and apply? Wouldn’t their businesses be better credit prospects?

Technology opens doors to better lending

For many independent banks, these questions are a no brainer. With the right small business lending technology, here’s how it can work:

- Online applications. Business customers submit their loan applications online. After all, business customers—millions of them Millennial-aged and/or tech savvy—are comfortable buying cars, shopping for homes, opening bank accounts, transferring money, applying for colleges, and much more: online.

- No more time-consuming, dead-end meetings eating up your loan officers’ time.

- No more outdated lending processes—your brand gets an instant upgrade.

- Best of all, no more tedious document gathering: applicants can upload all required documentation directly through the portal. This frees up hours of time each day for each loan officer.

- Customization and control. While LendingFront provides the technology, your loan officers continue to control the process—down to configurable criteria and other settings, and a white-labeled interface that makes the technology your brand’s.

- Automation. LendingFront automates as much as you want:

- Auto-approvals. The platform can evaluate and approve low-risk or risk-free small business loans almost instantaneously, based entirely on your own lending criteria.

- This is exciting for an SMB customer that needs the capital ASAP!

- For your bank, it amounts to greater revenue and a huge time savings—without relinquishing control.

- Auto-rejections. Similarly, the platform can reject certain applications instantaneously, based on any criteria (or combined criteria) you set.

- Easier discretion. For small business loans that aren’t a slam dunk one way or the other, your loan officers can continue to evaluate, work with small business applicants, and approve or reject as needed. The difference? Most of the steps in the loan officer’s lending process have been tightened and even eliminated.

- Auto-approvals. The platform can evaluate and approve low-risk or risk-free small business loans almost instantaneously, based entirely on your own lending criteria.

- New revenue streams. By cutting out mundane manual processes, automation increases the appeal of loans that your lending officers might not ordinarily touch—carving out juicier margins and making these loans suddenly worthwhile. And as these loans become increasingly lucrative, an entirely new revenue stream opens up.

- Better profits. Just like that: by implementing a fully digitized end-to-end solution, you boost your profits.

- Workflow visibility. Your loan officers gain instant visibility into their SMB loan workflows, with visually streamlined dashboards that can be absorbed at a glance—and provide helpful data for ongoing business strategies and goals.

Fully-funded loans at speed

With LendingFront, it’s possible for a small business loan to be fully-funded in less time than it takes to brew a cup of coffee. Then, your loan officers can send documents to applicants, get them e-signed, and transfer funds directly into their accounts, all without leaving their businesses.

Minimize job frustrations. Boost personal fulfillment. Make your lending officers more successful at saying yes. Try a free demo today.