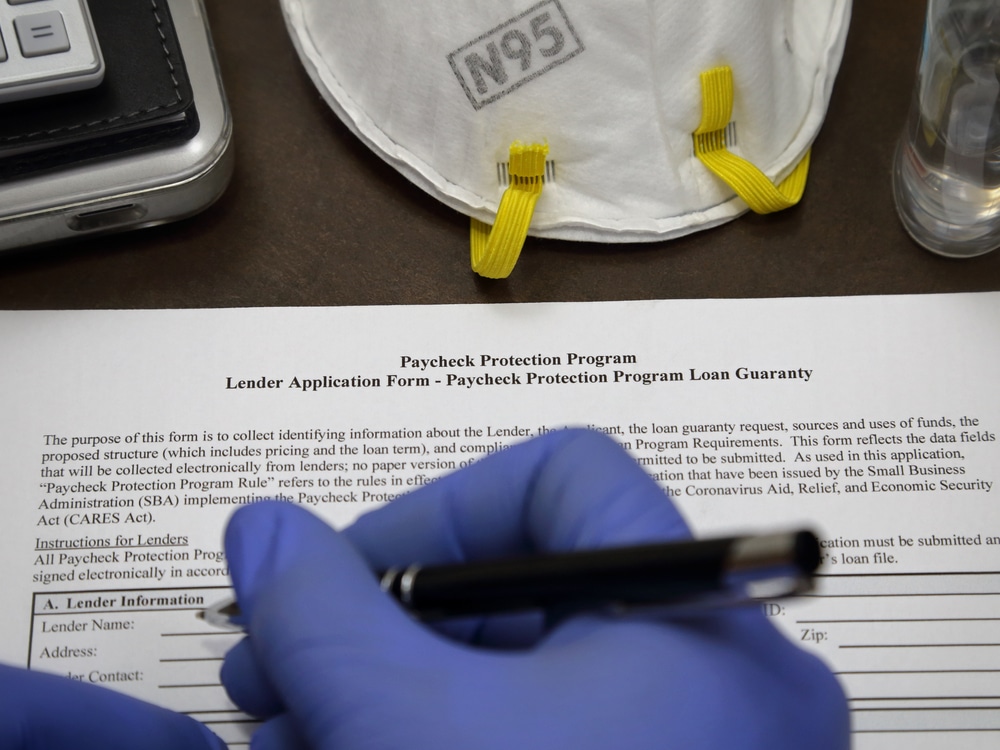

Amidst the COVID-19 crisis, demand for capital has spread throughout the US nearly as quickly as the virus itself—and this isn’t set to change anytime soon. As new sources continue to share the reality that COVID-19 is here to stay for the next two years, preparing yourself for the long-haul—while still meeting the needs of small business customers today—is a must. Adopting a face-forward, scalable mindset is key, but that doesn’t mean there’s nothing to learn from what’s recently transpired.

During just the first 13 days of PPP, unevenness quickly settled in. Small businesses in Nebraska received enough money to cover 81% of the state’s eligible payrolls, which stood in stark contrast to states like California (38%), District of Columbia (30%), and New York (40%). While much has unfolded since early April, there’s no question that banks and small businesses are both learning that distributed capital does not necessarily mean efficiently distributed capital.

What’s more, COVID-19 isn’t going to just disappear. Even if your state opens back up tomorrow, would you feel safe reopening all of your branches? Would your customers feel safe coming in? Here’s where digital comes in—and here’s how it can help you distribute capital efficiently and effectively throughout and after the COVID-19 crisis.

Channel money where it’s needed — regardless of where that is

Digital loan origination channels aren’t just more efficient solutions for banks, they level the playing field entirely. Of course, a digital lending solution couldn’t alone have solved something as sweeping as the uneven distribution of initial SBA funds. But there’s still an inherent lesson here: a digital lending solution can be what helps your bank even out and expedite your own capital distribution, as need continues to intensify across the nation.

Digital channels increase access for small business owners without the time or manpower to make the required phone calls, wait the necessary hold times, fax and mail documents, or comb through credit histories from years past. End-to-end digital solutions start from the beginning—offering digital document uploading and allowing users to simply link their bank account and historical financial data to the portal.

By increasing access and removing any barriers posed by physical location, you can set up your institution for smooth running—even after the dust settles. Small businesses will need post-crisis capital, and while some may be able to visit a branch, most will not. This hurdle isn’t anything new for small business owners. But it will be exacerbated by the circumstances of the crisis—and the continued presence of COVID-19. Digital lending solutions allow you to channel money where it’s needed—no matter how distant or disconnected that place may be.

Expedite lending processes to serve more small businesses

The first $342 billion in SBA loans tapped out in less than two weeks. Time is money, and banks equipped to act faster were—and still are—at an extreme advantage. As face-to-face vanishes during Coronavirus shutdown, digital lending takes its place, becoming the new normal; having a solution that can quickly adjust and accelerate your workflows is essential. With small business loans in higher demand—at higher stakes—than ever before, the livelihood of both your bank and your business customers depends on your ability to distribute capital effectively over the course of the next two years.

Adopting a digital loan origination channel is more than a fall-back option for uncertain times. It’s a sustainable way to integrate necessary technology, which monetizes your existing database of customers, opens you up to new ones, and unlocks newfound revenue streams through both. With the ability to implement automation from end-to-end, you’ll find relief in digital channels—and odds are, you’ve already experienced the pitfalls of the alternative.

How many phone calls can your loan officers and administrators field per day? How many emails, faxes, and letters? And in a world overrun with cutting-edge automation solutions, why should they have to?

A digital platform with an open, automated portal for processing, auto-approving (or rejecting), underwriting, filling, and even facilitating the repayment of small business loans expedites the lending process dramatically, and can be what catches you up—or even puts you paces ahead of the 74% of your competition that doesn’t offer digital options—during extended times of unprecedented, overwhelming demand.