Achieve the scale your lending business needs using the world’s leading end-to-end operating system for business lending.

Watch the Video

“The flexibility and strength of this system can meet the needs of an early stage startup all the way to that of a large financial institution. We would highly recommend this service..”

Small businesses need more capital than ever before. Is your lending program up to the task?

One Platform Endless Solutions

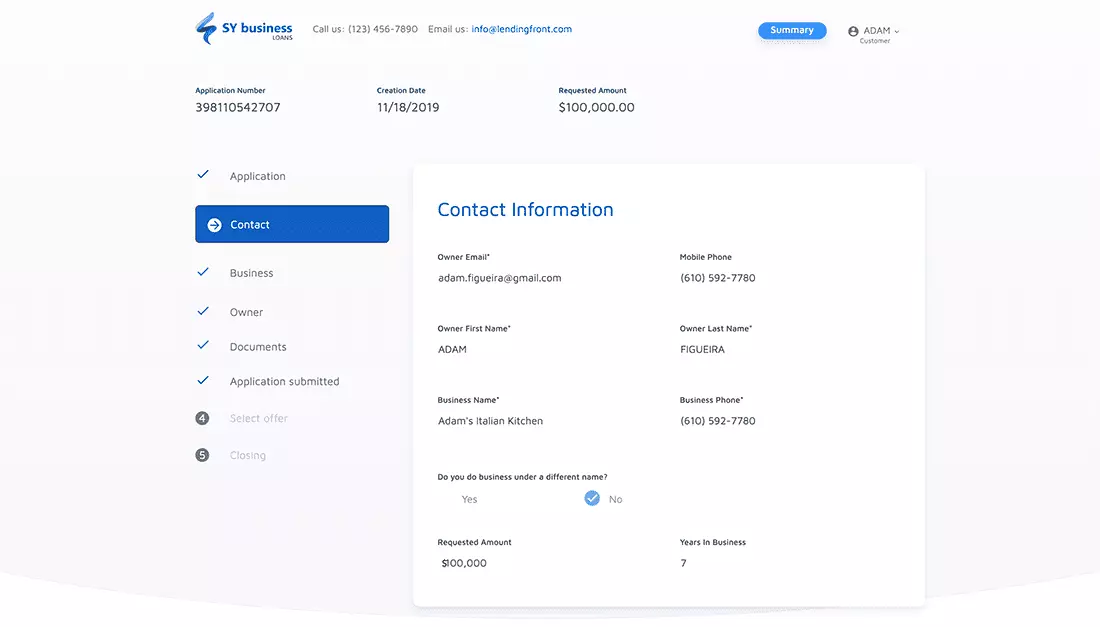

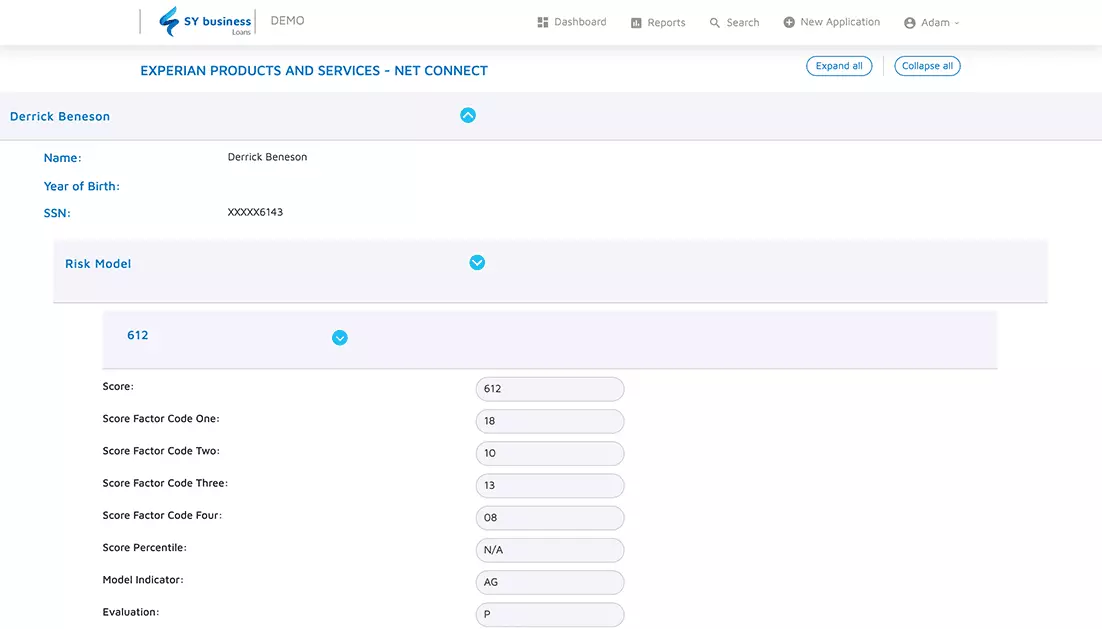

You’re only as fast as your slowest step. Unfortunately, for many alternative lenders, outdated technologies and disconnected systems make the process of extending capital slow, expensive, and unscalable. LendingFront’s end-to-end operating system for business lending delivers everything you need in a single package—application intake, data aggregation, underwriting, offer presentation, e-contracts, servicing, and more.

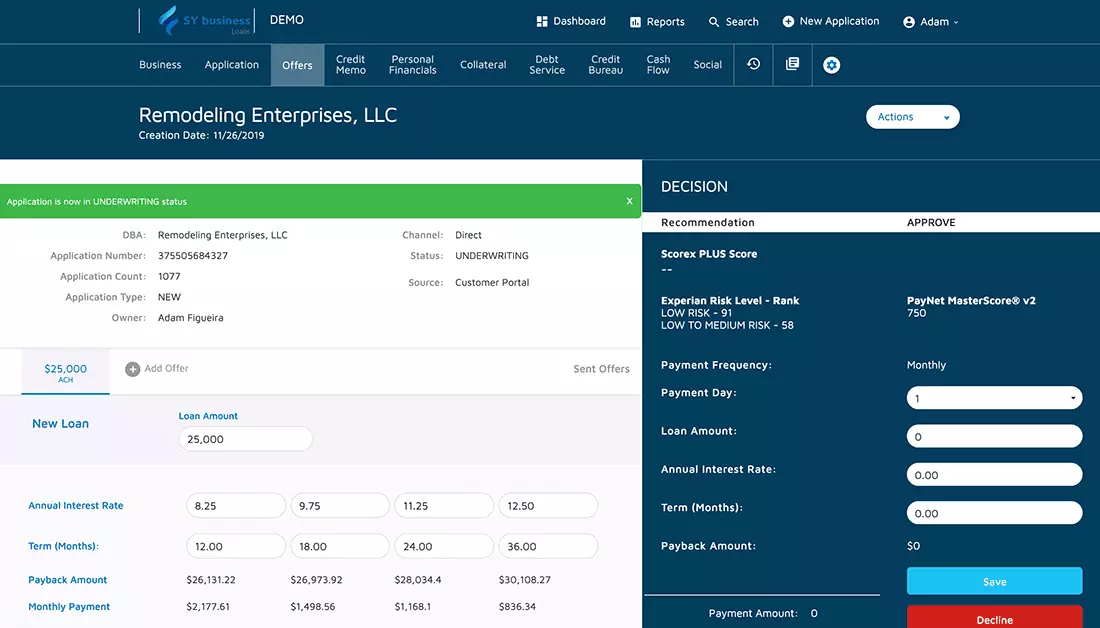

Automation and Rules-Based Decisioning

Eliminate manual processes that extend time and reduce efficiency. Whether it’s document collection, automatic status updates, or anything in between, LendingFront’s sophisticated workflow management capabilities make it easy to deliver a streamlined borrowing experience for time-pressed business owners. Define underwriting criteria, manage communications, deploy simple web-based loans contracts, and more.

Complete Control and Transparency

Unlike other lending solutions, we built ours to work the way you wanted it. From the application experience, required information, underwriting criteria, and more--LendingFront supports a 100% lender-defined process with no compromises around control or transparency. You’ll have access to a comprehensive activity audit of every action taken on each application—along with the ability to view your entire loan portfolio by Stage, Sales Rep, or ISO. A series of APIs also make it easy for you to build on top of LendingFront’s core operating system.

Built for the Future Ready for Today

Competition for business borrowers is higher than ever before. LendingFront helps you level the playing field. Our cloud-based delivery platform is complemented by daily backups, weekly vulnerability scans, continuous uptime monitoring, and the best professional services team in the business.

How LendingFront Works

LendingFront replaces the outdated technologies and disconnected systems that make your current program difficult to manage and impossible to scale. A single system—connecting both the borrower’s front-end along with the back-end used by your lenders—creates a streamlined experience that saves everyone time (even your ISOs).

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.