Help Your Merchants Do More—And Spend More With You

LendingFront helps you maximize value from every customer touchpoint—automating personalized product and financial offers so your team can focus on building, not selling.

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.

900

Loans made by a LendingFront customer in one year after going live. Before LendingFront just 27.

105%

Increase in funded dollars year/year for one LendingFront company (before and after LendingFront)

Turn Engagement Into Expansion

Revolutionize your SMB engagement

Turn platform usage into revenue opportunities

LendingFront uses platform and user behavior to pinpoint the best moments to cross-sell. Our white-label solution helps SaaS companies boost revenue automatically and at scale.

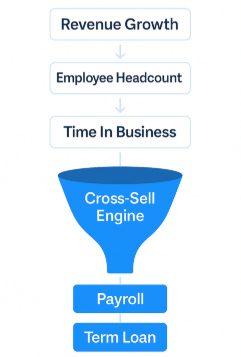

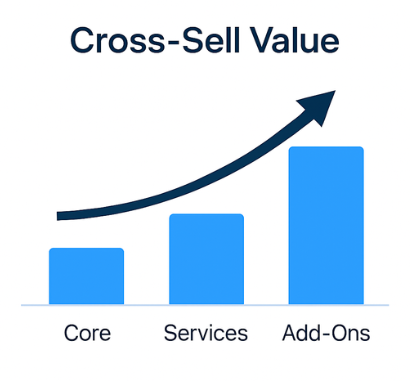

Upsell and cross-sell your software and services

Use data-driven insights to guide your customers toward higher-tier plans, adopt valuable add-ons, and sign up for your platform's services.

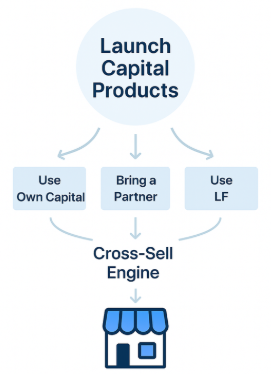

Launch and scale financial products

Offer capital and more—under your brand, on your terms. LendingFront’s end-to-end platform lets SaaS providers launch and scale financial products using their own resources, partners, or our network, with total flexibility and ease.

Sell more. Support more. Stay essential.

LendingFront helps you deliver an ecosystem that helps your SMB customers thrive. With smarter cross-sell strategies and embedded financial products, you can deepen relationships, increase revenue, and make your platform indispensable.

Grow Your Business by Powering Theirs

Financial Planning

Payroll

Line of Credit

SBA

Term Loan

Merchant Services

Deposits

Insurance

Credit Card

And More

How LendingFront Powers Growth for SaaS Platforms

Data Orchestration

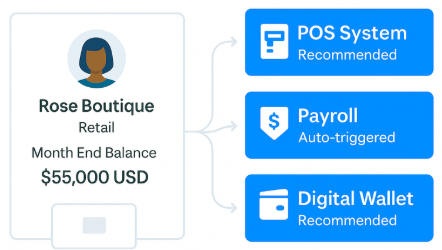

We turn your platform data into actionable insights—pinpointing which small business users are ready to upgrade, expand, or adopt new services. Our white-label solution helps SaaS companies prioritize outreach and drive revenue without adding operational overhead.

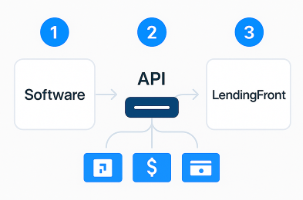

Seamless Integration

Embedded directly into your software, LendingFront enables always-on, data-driven product offers tailored to each SMB’s needs. Whether in-app, via email, or through your CRM, deliver timely financial and service recommendations that drive engagement and retention.

24/7 SMB Targeting Powered by Your Platform Data

With LendingFront, your platform becomes more than a tool—it becomes a revenue engine. We turn real-time usage data into actionable targeting, enabling you to surface relevant upgrades, services, or financial products to the right SMBs, 24/7. No manual effort, no guesswork—just intelligent growth at scale.

Protect SMB Data. Power Platform Growth

LendingFront is SOC 2 Type II certified and built for bank-grade security—using TLS, AES encryption, role-based access, MFA, and token-authenticated APIs to protect data at every layer.