Go Beyond Payments

You already have the relationships—LendingFront gives you the platform to turn those into revenue-generating opportunities.

LendingFront By The Numbers

7 to 1

One LendingFront customer consolidated seven legacy systems into one.

900

Loans made by a LendingFront customer in one year after going live. Before LendingFront just 27.

105%

Increase in funded dollars year/year for one LendingFront company (before and after LendingFront)

Transform Processing Data Into Growth

Revolutionize your SMB engagement

.png)

Leverage real-time transaction data

Leveraging your existing merchant data. Our platform scores and surfaces businesses that are most likely to need one or all of your products and services.

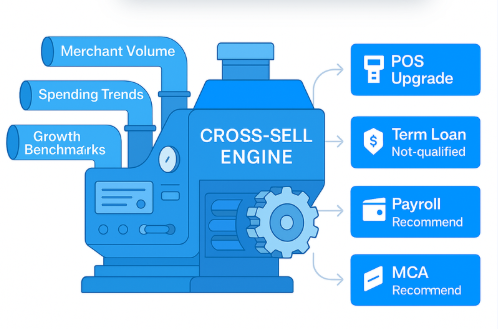

Cross-sell your own services

Effortlessly grow revenue by automatically offering the right merchants your POS, Payroll, Digital Wallet services and more —at exactly the right time.

.png)

.png)

Offer capital—with or without taking the risk

Deploy your own capital or avoid credit risk entirely—our end-to-end platform lets you offer Term Loans, MCAs, Lines of Credit, and more using your data and merchant relationships, or through our network of trusted lenders.

Cross-sell smarter. Defend your market.

Our white-label platform lets you offer more value under your own brand—helping you deepen relationships, increase revenue, and lock out competitors. Don’t just process transactions—own the full merchant experience.

.png)

Grow Your Business by Powering Theirs

Financial Planning

Payroll

Line of Credit

SBA

Term Loan

Merchant Services

Deposits

Insurance

Credit Card

And More

How LendingFront Powers Growth for Payments Platforms

Data Collaboration

LendingFront leverages your bank deposit data, proprietary AI models, and a robust benchmarking database to algorithmically score and prioritize small business customers based on behavioral patterns, inferred intent, and product-market fit.

Seamless Integration

Embedded directly into your software, LendingFront enables always-on, data-driven product offers tailored to each SMB’s needs. Whether in-app, via email, or through your CRM, deliver timely financial and service recommendations that drive engagement and retention.

Real-Time, Relevant SMB Offers—24/7

LendingFront automates your bank’s cross-sell process—identifying the right SMBs, delivering personalized offers, and driving conversions with minimal lift from your team.

Secure Data With Serious Growth

LendingFront is SOC 2 Type II certified and built for bank-grade security—using TLS, AES encryption, role-based access, MFA, and token-authenticated APIs to protect data at every layer.

.png)